.png)

With a growth rate of 6.2% in 2026, India has taken the top spot among G20 nations and is quickly emerging as a global economic powerhouse.

The US is predicted to increase at a rate of 2.1%, which is considerably slower than the global average of 3.1% GDP growth.

According to the International Monetary Fund's most recent report, India is emerging as a dominant force in the global economy, ranking first among the G20 nations with a growth rate of 6.2% in 2026. is expected to surpass large countries such as the US and China, even with single-digit growth. The US is predicted to increase at a rate of 2.1%, which is considerably slower than the global average of 3.1% GDP growth.

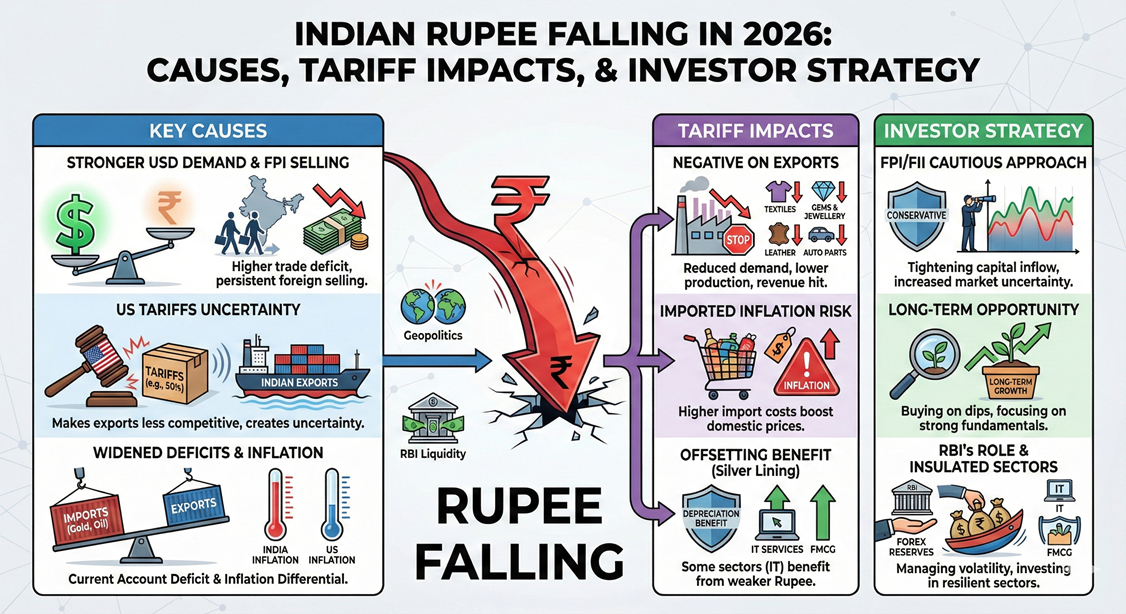

With good growth, the currency should have been strengthening even though it was the largest of the big economies. However, the Indian currency is at its lowest point, dropping to Rs. 91/- versus the US dollar, shattering the psychological barrier of Rs. 90/-, and ranking as Asia's worst-performing currency. Instead of asking "if," the investor now worries about "how far" it will go. The market is speculating that, as the currency isn't displaying any strength versus the dollar, would Rs. 100/- be the next stop?

The foundations of India's economy were insufficient to protect the currency. In actuality, the rupee couldn't be. It was ensnared in an ideal storm of outside pressure, fixed. The INR was negatively impacted by a significant outflow of foreign capital as well as Trump's imposed tariffs. The INR is the worst-performing currency in Asia due to a combination of external and domestic issues, including a growing trade deficit.

Basically, the tariff war has adversely affected the rupee.

Given India's ongoing imports of Russian oil, the biggest pressure on the Indian Rupee right now is the dramatic change in trade relations with the US. The United States reacted to India's disapproval of Russia by imposing an additional 50% tariff, while continuing to purchase oil from Putin. Due to the lack of a bilateral trade agreement between the US and India, Indian exporters are being negatively impacted since their margins are shrinking. As exporters stop sending dollars, the Greenback's allure as a haven is seen to soar, trapping INR in the vice.

Labour-intensive sectors like textiles have been severely impacted by these tariffs, and because the US is their main market, sectors like pharmaceuticals have also been hit hard.

Outflow of foreign capital / Net Selling of FIIs

Continuous selling of FII (Cash market) from the market also impacted the INR.

|

Month |

Net Sales |

|

January 2026 |

-41,435.22 |

|

December 2025 |

-34,349.62 |

|

November 2025 |

-17,500.31 |

|

October 2025 |

-2,346.89 |

|

September 2025 |

-35,301.36 |

|

August 2025 |

-46,902.92 |

Source: Money Control

Since FDI/DIIs kept investing in the market and generated a net inflow over the last few months, the market has experienced some optimism as a result of FDI. The situation is still the same when compared to FIIs, FDI, which kept flooding the market with capital throughout 2025 and this January.

What would be the Impact of the USA-India Trade Deal?

However, on account of the recent USA-India trade deal, tariffs are reduced from 50% to 18% and reducing tariffs can help stabilise or strengthen a falling INR, but the impact depends on why the rupee is weakening and how trade flows respond.

How lower tariffs can support the INR:

- Boosts exports competitiveness

- Lower tariffs from trading partners make Indian goods cheaper abroad.

- Higher exports → more foreign currency inflow (USD, EUR).

- Increased forex supply strengthens the rupee.

That means if the United States lowers tariffs on Indian textiles or pharma, exporters receive more USD and INR demand rises.

- Encourages foreign investment & trade integration

- Lower trade barriers signal openness and policy stability.

- Improves investor confidence.

- Can increase FDI & portfolio inflows.

More capital inflow means a stronger INR.

- Improves trade balance (if exports rise faster than imports)

- Increased exports can reduce the current account deficit.

- Lower deficit reduces pressure on INR.

However, there can be a situation where tariff cuts could weaken INR:

- Imports may surge

If India reduces tariffs:

- Cheaper imports of (electronics, machinery, oil substitutes).

- A higher import bill means more USD demand.

This risk is high if:

- Domestic manufacturing is weak

- Consumers prefer imported goods

- Short-term current account widening

- Imports respond faster than exports

- Trade deficit may widen

- INR may weaken temporarily

Net impact on currency depends on:

- Whether tariff cuts are reciprocal

- Export sectors' ability to scale

- Oil prices & global demand

- Capital flows (FII/FDI)

- RBI intervention & forex reserves

The tariff cuts can strengthen the INR but only if they increase exports and capital inflows. On the other hand, they can weaken INR if imports surge faster than export growth.

In India’s current context:

Tariff reductions could support INR if they:

- Increase export access

- Boost manufacturing exports

- Attract supply chain relocation

- Improve trade agreements

But could hurt INR if they:

- Increase dependence on imports

- Widen trade deficit

- Reduce domestic production

What should Retail Investors do?

Tariff changes create mixed effects. Some sectors will benefit, and some sectors may face pressure. Currency may swing. Hence, retail investors should not predict the market or try to time the market.

Instead of betting on one outcome or sector, build a balanced portfolio and diversify it. Mutual funds with a long-term view will always help you build a stable wealth-creating portfolio.

Follow for daily updates: WhatsApp | LinkedIn | YouTube | Instagram | Facebook | X | Pinterest

.png)